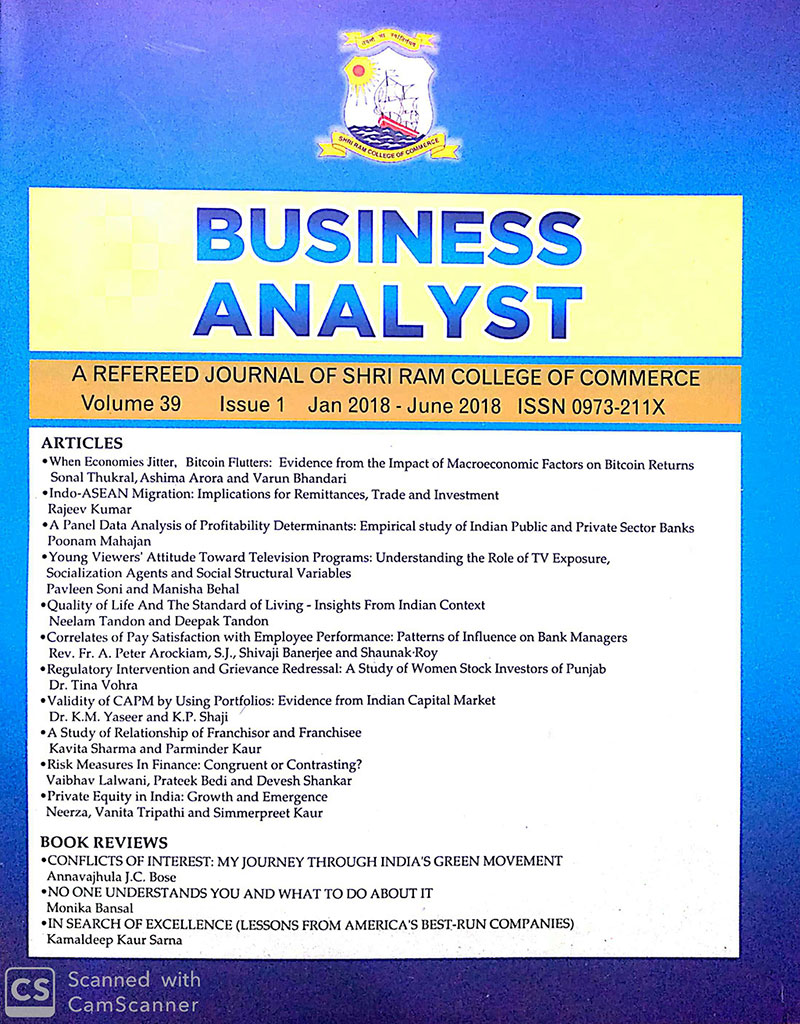

WHEN ECONOMIES JITTER, BITCOIN FLUTTERS: EVIDENCE FROM THE IMPACT OF MACROECONOMIC FACTORS ON BITCOIN RETURNS

Sonal Thukral, Ashima Arora and Varun Bhandari

Volume 39, Issue 1 (January 2018 to June 2018)Abstract

Download ArticleThe study attempts to explore the growth rate of Bitcoin for the sample countries followed by investigation of significant macro-level variables on returns of Bitcoin by considering a panel of different countries from 2013-2016. For this purpose, the paper tries to assess the impact of economic development and financial development of the economy on the returns of Bitcoin. The study employed Panel data Regression Model encompassing the pooled, fixed effect and random effect analysis followed by Hausman Test to select the appropriate model for analysis. Subsequently, using various econometric tools different OLS assumptions were also tested. The results indicated a rising interest of investors in Bitcoins despite sufficient associated risk. Analysis revealed an inverse relationship of economic development, and financial development with Bitcoin returns. The ’spread’ displays a significant linear relationship with Bitcoin returns, hinting at an emerging speculation in the Bitcoin market. The implication of the study lies in its ability to assist the market players to estimate the prospect of future adoption and survival of Bitcoin especially for e-commerce traders that explore cost-effective and time-efficient payment methods for mainstream adoption. Further, our results also provide cues to the government and central authorities towards impending regulation of this financial innovation to contain the risk of probable derailing the global economy stability.

INDO-ASEAN MIGRATION: IMPLICATIONS FOR REMITTANCES, TRADE AND INVESTMENT

Rajeev Kumar

Volume 39, Issue 1 (January 2018 to June 2018)Abstract

Download ArticleThe paper focuses upon the labor emigration from India to the ASEAN countries and its implications for Indo - ASEAN trade. India's geographical location is such that it has to remain in contact with the South- East Asian countries for trade in goods and movements of people and the facts remain that India had been in such contacts for several centuries for trade. However the history of Indian labor migration to the ASEAN region is not very old. It started during the colonial period in 19th century when the British Indian government sent many Indians to work in its plantations in South East Asia. Later many of these emigrants settled there. Presently the rate of Indo-ASEAN migration is quite high with over one third of a million of Indians migrating annually to this region. At present over three million overseas Indians are living in the entire ASEAN region. Such magnitude of the movement of Indians to this region has important implications for Indo-ASEAN trade, remittances and investment. This paper tries to highlight this connection using UNO’s bilateral migration and remittances data, Word Bank’s data on trade and investment and data from other important sources like UNCTAD, ILO, IMF and IOM.

A PANEL DATA ANALYSIS OF PROFITABILITY DETERMINANTS: EMPIRICAL STUDY OF INDIAN PUBLIC AND PRIVATE SECTOR BANKS

Poonam Mahajan

Volume 39, Issue 1 (January 2018 to June 2018)Abstract

Download ArticleThe present paper empirically analysis the determinants of profitability of 26 Public and 19 Private sector banks in India for the period from the year 2011-2016. Theoretical framework is based upon Market Power Theory (Bain, 1951) -and Signalling Theory (Arrow, 1972 and Spence, 1973). Secondary source of data has been used. Return on Assets (ROA) has been used as a predictor of profitability of the Indian Banks. Independent variables, namely spread ratio, provision and contingencies, Credit Deposit Ratio, Operating Expenses Ratio, Profit per Employee, Business Per Employee, Non-Interest Income, Investment Deposit Ratio, Capital Adequacy Ratio, Non Performing Asset Ratio, Type of Bank have been used. Correlation and Panel Data Regression Analysis has been used. Multicollinearity has also been checked with the help of VIF values. Various Hypotheses have been developed on the basis of review of literature to test the association between profitability of respective banks and other independent variables. The results show that 64.94% variation in ROA is explained by variations in independent variables. The study also reveals an interesting result that provision and contingencies (negative) significantly influences the profitability of banks @10%, Non-Interest Income (positive), Business per Employee and Capital Adequacy Ratio (positive) @5%, Profit per Employee (positive) and Investment Deposit Ratio(negative) @1% respectively. Various variables namely Spread and Credit Deposit ratio have positive insignificant association with profitability and Operating expenses; Non-Performing Assets have negative insignificant association with profitability.

YOUNG VIEWERS’ ATTITUDE TOWARD TELEVISION PROGRAMS: UNDERSTANDING THE ROLE OF TV EXPOSURE, SOCIALIZATION AGENTS AND SOCIAL STRUCTURAL VARIABLES

Pavleen Soni and Manisha Behal

Volume 39, Issue 1 (January 2018 to June 2018)Abstract

Download ArticleThe authors adopt a socialization explanation for young viewers’ attitude toward television programs. Attitude is theorized as an outcome of socialization process, involving two socialization agents: parents and mass media. In particular, it is hypothesized that family communication (socio-oriented communication and concept-oriented communication), parental television mediation (active mediation, restrictive mediation and co-viewing), preference for watching television programs, extent of television viewing along with socio-structural variables (age, gender and pocket money) are related to attitude. The results suggest that the proposed socialization model of young viewers’ attitude toward television programs is supported by data from a sample of school and college students except for two variables age and pocket money. Finally, implications for marketers are presented.

QUALITY OF LIFE AND THE STANDARD OF LIVING: INSIGHTS FROM INDIAN CONTEXT

Neelam Tandon and Deepak Tandon

Volume 39, Issue 1 (January 2018 to June 2018)Abstract

Download ArticleGDP per-capita as proxy of Standard of living and life expectancy at birth as proxy of quality of life has been a thought provoking concern in the minds of researchers. In the Indian context the data for the period 1965-2015 has been gathered, massaged and interpolated by the authors and has yielded plausible results. The authors investigated the problem and from the review of literature found that no empirical analysis if there from the Indian standpoint .The authors applied various econometric tools viz. unit root test , Co-integration and further putting in the vector correction model to capture both the short-and long-run behavior of the variables. In the short run, lagged changes in India’s GDP per-capita is not significantly associated with changes in life expectancy of people in India. The authors have concluded through the vector error correction model that per-capita Gross Domestic Product and life expectancy have a significant long -run adjustment mechanism. The long run causality is directional for Indian government to significantly increase GDP expenditure ratio on health to achieve holistic growth of India but not just GDP per-capita growth rate.

CORRELATES OF PAY SATISFACTION WITH EMPLOYEE PERFORMANCE: PATTERNS OF INFLUENCE ON BANK MANAGERS

Rev. Fr. A. Peter Arockiam, S.J., Shivaji Banerjee and Shaunak Roy

Volume 39, Issue 1 (January 2018 to June 2018)Abstract

Download ArticleIt is a well-documented fact that pay is a significant motivator. Notwithstanding, the notion that higher pay leads to higher satisfaction is not without debate. In common parlance, pay level satisfaction refers to an individual’s direct wage and salary compensation and is regarded as one of the most important job attributes for an individual. Therefore, it may be opined that pay satisfaction is a blend of both the monetary as well as non-monetary components, since pay, although by itself is a necessity, but not however, a sufficient condition for job engagement. Accordingly, in this endeavour, we shall seek to examine the dimensions and determinants of pay satisfaction among bank employees, under investigation. We shall also seek to provide a brief insight into the various ethical issues associated with administering pay in private banks, in addition to fathoming how this delicate area under discussion can be as administered in practice. The research is particularly unique, given that very limited studies have been conducted in this domain, especially in the Indian milieu, owing to its rather sensitive disposition and subjective understanding. Further, pay is deemed to be a major determinant of job satisfaction, thus making the study both relevant and purposeful. Our study is based on a meticulous survey of middle-level and top-level employees working in private banks situated in the city of Kolkata, India. A self-administered questionnaire with various items related to the study dimensions was employed to obtain feedback from the respondents. We have been able to identify the most important determinants governing pay in an organization. Further, the findings of our study clearly demonstrate a positive liaison between pay structures and levels of job satisfaction. Interview results further revealed that the respondents expressed discontentment with their salaries in relation to their workload, work-timings, career growth opportunities and organizational commitments. Now, it must be heeded that the study has been conducted on a limited geographical region (Kolkata, India) while being pillared on the perceptions of these bank employees, which are rarely flawless and hence sport the inherent risk of being imperfect. The study however, furnishes valuable insight into the dimensionalities and determinants of pay satisfaction, while seeking to proffer strategic guidelines to private banks in designing an effective pay structure that would be conducive to employee satisfaction, employee engagement and ensure their retention in the workplace. We have conceptualized pay satisfaction and have used Structural Equation Modelling (SEM) to analyse the data. Results showed favourable responses between all the constructs present in the model. Given that monetary and non-monetary aspects of pay both have a significant impact on pay satisfaction, as evidenced through the path diagram results, satisfaction with pay, in turn has a significant impact on job satisfaction, thereby triggering favourable responses with employee performance. It is thus evident that pay satisfaction, although a silent factor in case of several employees, is a necessary and critical consideration and point of reference when it comes to improving their productivity levels in the enterprise. The study shall help managers and students in understanding the nuances of pay as a critical component in the development of overall job satisfaction and employee performance.

REGULATORY INTERVENTION AND GRIEVANCE REDRESSAL: A STUDY OF WOMEN STOCK INVESTORS OF PUNJAB

Tina Vohra

Volume 39, Issue 1 (January 2018 to June 2018)Abstract

Download ArticleThe resolution of investor grievances is an indicator of the efficient working of the regulatory mechanism in a country. Although the securities market in India has witnessed a significant growth since the establishment of SEBI but as far as SEBIs performance in redressing the grievances of investors is concerned especially in case of women investors, SEBI needs to review its grievance redressal mechanism. Winning the confidence of its investors especially women investors is very important for the regulator. Women being risk averse investors have greater concerns about the efficiency of the grievance redressal mechanism and are less likely to invest in the securities market in the absence of an effective grievance redressal mechanism. Therefore, the study is an attempt to probe into the efficiency of the grievance redressal mechanism set up by SEBI in solving the problems of women stock investors of Punjab. For the purpose of the study, data was collected from primary sources using a pre tested, well structured questionnaire. Descriptive Statistics as well as Percentage Analysis have been used in order to analyze the collected data. The results of the study brought out that majority of the women did not register a complaint with SEBI because they were not aware about the procedure of complaint registration. Among those who registered their complaints, had registered their complaints online, but still a number of them made use of the investor helpline numbers in order to register their complaints. As far as the reply to these complaints is concerned, all the complaints were attended to but grievance cases with multiple issues were found difficult to resolve and hence the complaints in such cases remained pending. The paper suggests that SEBI needs to carry out extensive investor education initiatives in order to educate the women investors about its grievance redressal mechanism, to empower them and to increase their participation in the stock market. Moreover, SEBI should invite suggestions from the investors in order to improve its already existing grievance redressal mechanism.

VALIDITY OF CAPM BY USING PORTFOLIOS: EVIDENCE FROM INDIAN CAPITAL MARKET

K.M. Yaseer and K.P. Shaji

Volume 39, Issue 1 (January 2018 to June 2018)Abstract

Download ArticleThis article tests the validity of Capital Asset pricing Model and compares the results of 16 periods including 14 sub periods which comprises 3 years each for the prediction of the expected returns in the Indian capital Market. The tests were conducted on portfolios having different security combinations. By using Black Jenson and Scholes methodology (1972) the study tested the validity of the model for the whole and different sub periods. The study used daily data of the BSE 100 index for the period from January 2001 to December 2010. Empirical results mostly in favor of the standard CAPM model. However, the result does not find conclusive evidence in support of CAPM.

RISK MEASURES IN FINANCE: CONGRUENT OR CONTRASTING?

Vaibhav Lalwani, Prateek Bedi and Devesh Shankar

Volume 39, Issue 1 (January 2018 to June 2018)Abstract

Download ArticleRisk has been defined and measured in different ways by academicians and practitioners. The choice of proxy for risk measurement can have a direct and conclusive impact on investment decisions. The question that we aim to answer in the study is: Does the choice of risk-adjusted performance measure really make a difference in the ranking of equity portfolios? To approach the issue, we categorise risk-adjusted performance measures in four groups: Volatility Based Risk Measures; Sensitivity Based Risk Measures; Downside Risk Measures and Tail Risk Based Measures. We calculate values of all these risk-adjusted measures for 111 equity growth oriented mutual fund schemes spread across AMCs (Asset Management Companies) in India for a period of 10 years starting June 2005 to June 2015. We use Spearman’s and Kendall’s rank correlation and prepare a cross-sectional matrix to find out the extent of congruence among ranking of schemes according to all risk-adjusted measures. We find a substantial degree of positive and significant concordance among rankings obtained by equity portfolios on the basis of different for risk-adjusted measures with rank correlations ranging from 0.61 to 0.99. The results of the study indicate that the choice of risk-adjusted measure is broadly inconsequential to investment decisions in the context of Indian equity markets. The findings are relevant for retail and institutional investors, fund managers, market regulators and academicians.

PRIVATE EQUITY IN INDIA: GROWTH AND EMERGENCE

Neerza, Vanita Tripathi and Simmarpreet Kaur

Volume 39, Issue 1 (January 2018 to June 2018)Abstract

Download ArticleThe purpose of this study is to understand the trend, growth and emergence of private equity investment in India. Study involves discussion on the concept of private equity, its structure, emergence and drivers of growth. Data on private equity investment (deal value and volume) and exit (deal value and volume) is collected from 2004q1 to 2017q and log-lin regression analysis is performed. Study finds that private equity investment is a volatile activity in India. Over the past 13 years (2004-2017), the year 2015 attracted maximum investments and witnessed highest exits from private equity investors. IT&ITeS and real estate are the most preferred sectors. And late and growth stage companies are the most desired businesses for investment such institutional investors. Regression analysis report quarterly growth of 3.8% in investment value and 2.8% in investment volume from private equity investors. Also, results show quarterly growth of 3.4% in exit value and 2.7% in exit volume.